Help to Buy Is Nearly Over: What Are Your Options Now?

I'm a first time buyer, get me out of here

This week we learnt that the Help to Buy Equity Loan scheme would be shutting its doors early - meaning buyers would now have to reserve a home by the end of October, as opposed to the end of the year 😱. I won’t lie, it’s not looking great for first-time buyers. For exactly why it’s so hard, have a watch of this reel:

But if you’re hoping to buy, what are your options now? This guide answers that very question.

As I’ve explained in the video, what we need more than ever are sustainable solutions which solve the systemic problem of high property prices but in the absence of that, there are schemes available making it possible and easier to own a home.

TLDR: average house prices in the UK are now 9 times the average housedold income (even more in London) and because your affordability is determined by your deposit and income this makes it incredibly difficult for the average person to buy a property. Unless you’ve got a trust fund, rich uncle or you’re earning a lot, it’s not going to be easy.

Let's get to it

The Schemes

95% Mortgage Guarantee scheme

Help to Buy Equity Loan

The Help to Buy Equity Loan scheme allows you to borrow up to 20% of the cost of a new home (up to 40% in London) from the government in addition to your mortgage. Of course, there are things to consider: while the equity loan is interest-free for the first five years, costs can accelerate from year six onwards and new builds are notoriously inflated in price. Do your research on the Help to Buy equity loan scheme here before making the move.

Importantly, the Help to Buy Equity Loan scheme is ending. You will have to reserve a property by October.

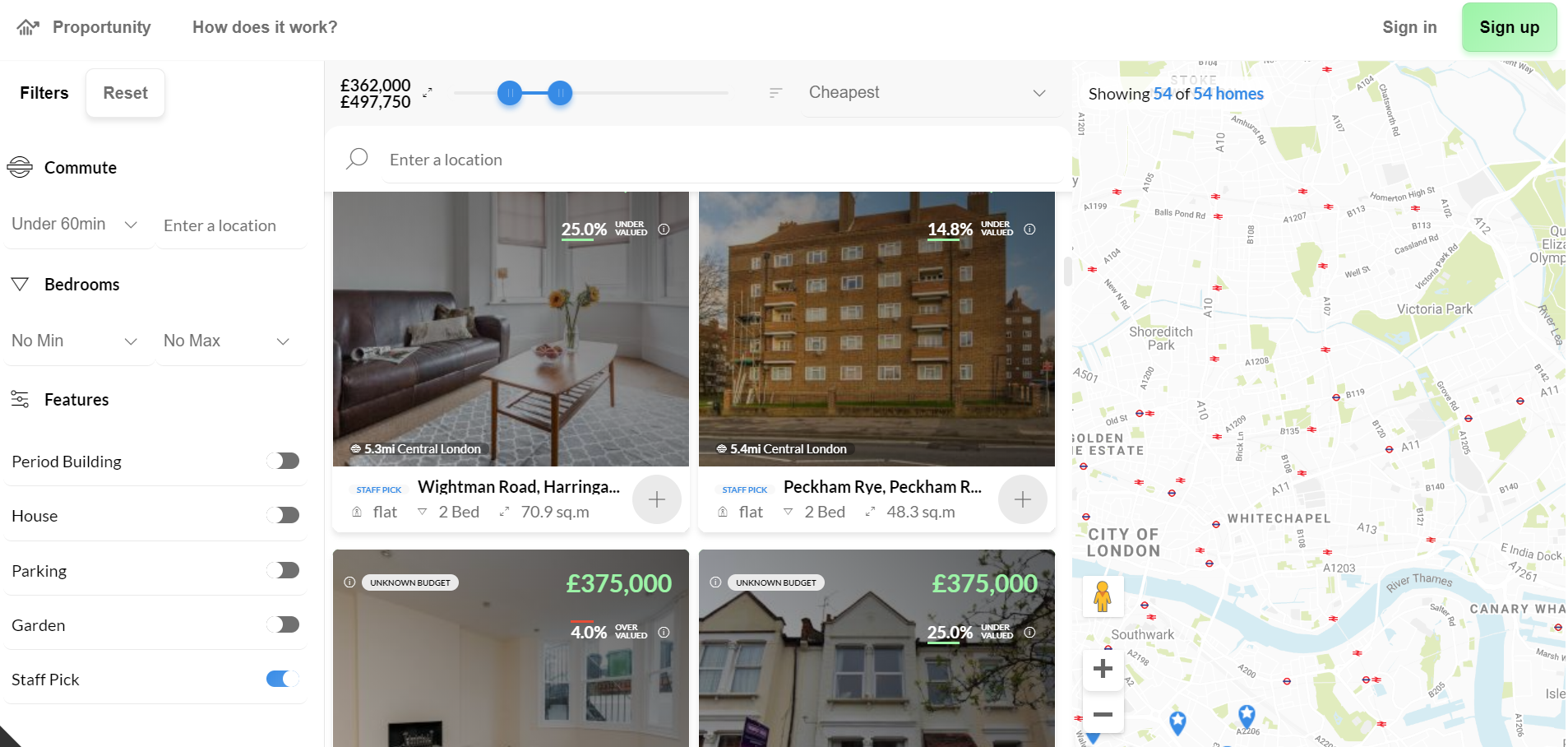

NEW Private Help to Buy schemes e.g Proportunity, AHauz

As we say farewell to Help to Buy, a number of companies are looking at other ways to help first-time buyers. A kind of private Help to Buy Equity Loan if you will.

A quick summary

Proportunity or Ahauz is very similar to the government’s Help to Buy Equity loan. Rather than lending you a fixed sum of money to repay, Proportunity lends a percentage of the value of the property (a shared equity loan). With the help of a mortgage adviser, you can choose between 10-25% of the home that you are buying. When you pay back the loan, the home is re-valued, and you pay back the same percentage as agreed for the loan. This may mean a higher repayment if the value of the property has appreciated, or a lower repayment if the value of the property has fallen. For example, if they provided a 20% loan to you, at the time you chose to re-pay the loan, the property would get re-valued and you would pay back 20% of the new value of the property.

The details

These loans are very similar to the government’s Help to Buy Equity loan. Rather than lending you a fixed sum of money to repay, Proportunity lends a percentage of the value of the property (a shared equity loan). With the help of a mortgage adviser, you can choose between 10-25% of the home that you are buying. When you pay back the loan, the home is re-valued, and you pay back the same percentage as agreed for the loan. This may mean a higher repayment if the value of the property has appreciated, or a lower repayment if the value of the property has fallen. For example, if they provided a 20% loan to you, at the time you chose to re-pay the loan, the property would get re-valued and you would pay back 20% of the new value of the property.

What properties is it available on?

Not every property under the sun but Proportunity are more flexible than the government Help to Buy scheme (which is new builds only). Unlike Help to Buy, they’re using technology (machine learning) via their Proportunity Home Index platform to work out which homes are a good investment and most likely to go up in value (this benefits them too). You can submit a home you'd like to buy for approval or view their list of approved homes.

Things to note:

- They are FCA regulated and authorised

- Trustpilot = 4.6

- There are early repayment charges that vary depending on which product you choose (5% of the loan value in the first year, and then decreasing by 1% each year over 5 years)

- The interest rate is higher than your average mortgage but with the affordability you unlock, you could access better interest rates on your main mortgage.

- The interest rate is fixed for 5 years

- Unlike Help to Buy there are no regional price caps and you are not limited to just new-builds which is a big win.

Overview: I would love to see more affordable homes built in the UK but in the absence of that and more government help, Proportunity and private ‘help to buy’ schemes are needed. They aren't for everyone but with the ending of the Help to Buy Equity Loan scheme plus increasing interest rates, it’s not getting easier for first-time buyers so I’m glad to see solutions like this. It’s particularly useful for people who are trapped paying expensive rent and need to accelerate the process of buying.

To give you an idea of who Proportunity and similar schemes are most useful for, I would suggest this product to a friend paying expensive rent who is struggling to save a larger deposit and can’t wait another two years or an expecting couple who desperately need additional help affording a two-bed place. The interest rate on the loan isn’t low so you will pay more but that is likely to be justifiable for many, particularly those outlined in the examples above. If in doubt, please chat with a mortgage broker who can give you advice on whether this is right for you.

Lifetime ISA

A personal fave. The Lifetime ISA is a great way to start investing and save a house deposit (or for retirement). You’ll get a free 25% bonus every year on savings up to £4,000 (that’s a sweet £1,000). It can be used in addition to all of the schemes mentioned here. One thing to be aware of is that the house price limit is £450,000 (there are campaigners calling for this to be increased and I’m with them).

Shared Ownership

Your final option could be the Shared Ownership scheme, which helps you to buy part of a property and rent the rest. It’s a great option for some but understanding the risks and advantages is super important. You can start with a little as a 10% share and the rent is usually less than the rate charged on the open market.

How do I find one?

They’re often found in new private developments (developers are usually required to include ‘affordable housing’ in order to get planning permission.) They are always leasehold properties.

You can buy second hand shared ownership properties called ‘resales’. These are properties where the current owner is selling their share. In both cases, (unless they are ‘fixed equity’) you can buy additional shares in the future until you own it outright, if you wish.

What size share can I buy?

Under the new shared ownership scheme the minimum share is 10%. You can then increase your share through a process called ‘staircasing’ where you incrementally buy 1% shares of the property until (if you wish), you own 100%.

Things to note

- There have been horror stories of people being ripped off with expensive ground rent and service charges. Always check this before you buy

- Staircasing costs money although under the new shared ownership scheme these fees have been cut significantly

- Selling a shared ownership property can be a little more complicated and you have a limited market (unless you’ve staircased to 100%)

Closing thoughts

So there we go, a round-up of all the schemes available to anyone hoping to get on the property ladder. If you have any questions, please drop me a DM and I’ll update this article with an FAQ section.

Join the party 🥳

✅ A monthly 💷 round-up straight to your inbox